Stephen Vance, Staff

After balking at a budget framework for 2019 presented to council on December 10, which included a proposed maximum increase of 5.6 percent to the 2019 tax levy, council has unanimously approved a revised budget framework with a proposed maximum levy increase of 3.65 percent.

In rejecting the previously presented framework council expressed concern about both the 5.6 percent rate increase as well as a proposed 3.1 percent increase to staff salaries. The revised budget framework proposes a 2.3 percent increase in municipal salaries based on a 12-month average of the Ontario Consumer Price Index.

Councillors were much more comfortable with the revised budget framework presented at their January 7 meeting.

“It’s a much better starting place,” noted Councillor Ross Kentner.

Kentner wasn’t alone in his preference for the revised budget framework document presented to council.

“In my mind it’s a really great place for us to start,” offered Councillor Tony Bell, who was particularly pleased with the road and bridge infrastructure projects included in the framework.

At the core of the budget framework are ten key directions from council:

-

Direct staff to prepare a draft budget including an overall tax levy increase not to exceed 3.65%

-

Direct staff to prepare a draft tax-supported operating budget with an increase not to exceed 2.3%

-

Direct staff to prepare a draft budget inclusive of a 1% tax levy increase dedicated for roads capital funding under the Road State of the Infrastructure report’s “Preservation Model”, as approved by Council in September 2014

-

Direct staff to prepare a draft budget inclusive of a 1% tax levy increase dedicated for bridge capital funding under the Bridge and Culvert State of the Infrastructure report as approved by Council in June 2016

-

Direct staff to prepare a draft budget inclusive of a 0.5% tax levy increase dedicated for facility capital funding under the Integrated Study: Facility Condition Assessment, Accessibility Assessment, and Energy Audit report as approved by Council in October 2016

-

Direct Staff to prepare draft tax and user pay operating budgets incorporating a Cost of Living salary adjustment of 2.3% based on the 12-month average Ontario Consumer Price Index (November 2017 to October 2018)

-

Direct staff to budget any tax levy increases resulting from real assessment growth due to new development and building construction estimated at 1.15% to offset the current year budget increases

-

Direct staff to prioritize the reconstruction of 4th Sideroad from the 3rd Line to the Meaford/Blue Mountains Townline over other reconstruction projects contained in the Road SOTI for the 2019 Capital budget

-

Approve the allocation of $449,983 from the OCIF formula based component towards bridge rehabilitation costs and include within the 2019 budget for Bridge 017 – Shields Bridge rehabilitation project

-

Approve the allocation of $74,409 from the 2016 Operating surplus and $332,910 from the 2017 Operating surplus towards funding the reconstruction of road and drainage costs on Concession A from Sideroad 18 to Eagle Ridge Drive.

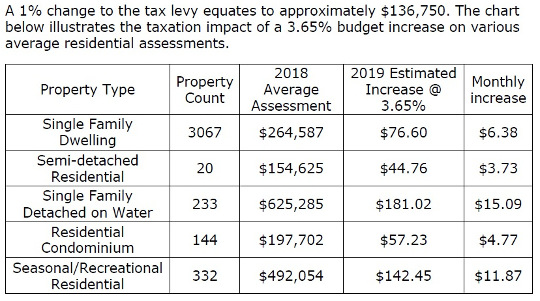

The table below shows the impact of a 3.65 percent property tax increase for property owners:

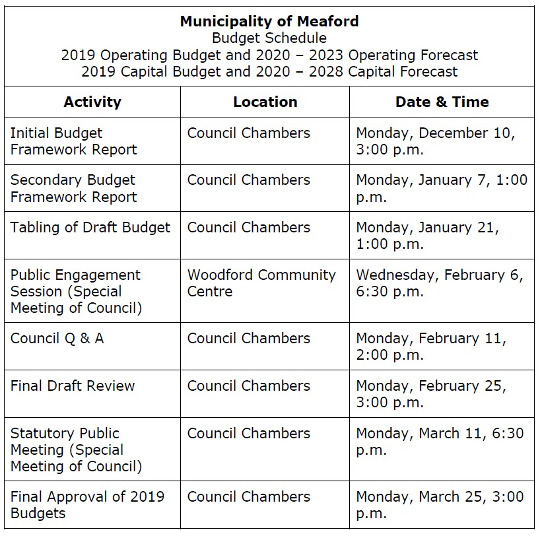

The schedule for this year’s municipal budget process shown in the table below: