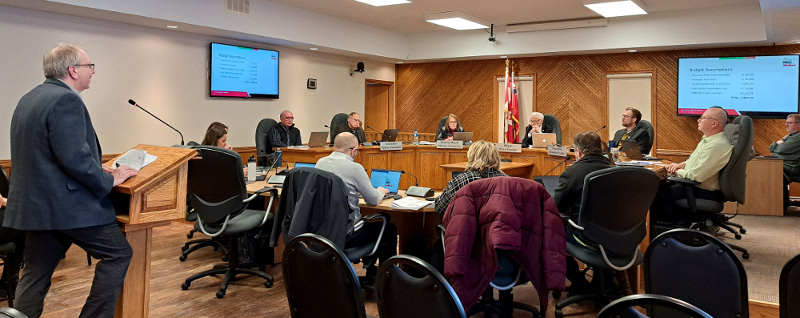

Municipal budget season is underway for Meaford’s council after the draft budgets for 2023 were presented to councillors on Monday, January 30.

CAO Rob Armstrong presented the draft budget to council, noting that municipal staff began preparing for the 2023 budgets in July, and due to it having been an election year, staff used the 2022 budget framework as a guide in preparing the draft budgets for 2023.

As has been the practice in recent years, the draft budget includes a 1% tax levy increase dedicated for roads capital funding, a 1% levy increase for capital funding for bridges, as well as a 0.5% levy increase dedicated to municipal facility capital funding.

Also included in the operating budget is a 2.5% cost of living increase for municipal staff.

Armstrong noted that the cost of Meaford’s insurance policy premiums are increasing by 14% in 2023, adding $31,610 to the budget. Other increasing costs noted by the CAO include fuel, which is expected to cost the municipality $66,000 more in 2023 than the previous year, the Grey Sauble Conservation levy increases by $10,580, and Meaford’s contract with the Owen Sound North Grey Regional Public Library is increasing by $6,470.

In 2023, the Municipality is expected to see an increase in their Ontario Municipal Partnership Fund (OMPF) allocation, from $1,241,600 to $1,311,400, an increase of nearly $70,000.

In order to offset the costs for waste management, and to avoid increasing the cost of bag tags, the municipality will for the third year in a row use $130,000 from the waste management reserve in order to offset 2023 costs. Armstrong noted that the province will soon be taking over municipal blue box recycling programs, which will ultimately result in savings for the municipality.

The 2023 tax-supported capital programs will require $5.2 million in ratepayer funding for roads and bridges as well as municipal fleet and facility management and other capital expenditures.

The draft budgets presented to council reflect a required rate increase for 2023 of 7.10%, though members of council have expressed that they will work to reduce the required increase during their budgeting sessions to be held in late February.

Councillor Harley Greenfield reminded those viewing Monday’s council meeting that the tabling of the draft budgets is just the beginning of a lengthy process, and the required rate increase included in the draft budgets will change.

“Just because our council moves today to accept this budget, this presentation with an increase of 7.10%, does not mean that it is going to end there,” Greenfield reminded the public. “This is only the beginning.”

Councillor Steve Bartley told council that he hopes that they will be able to find opportunities for cost savings that will allow the ultimate required rate increase to be closer to 4%.

“I’ve watched a lot of budget deliberations this year so far in other municipalities, and there’s only one finalized that I know of, South Bruce,” Bartley told council. “They are all over the map ranging from 17% to 7%. South Bruce has done it two years in a row, and the county did it this year, where they picked a figure where they wanted to land, and truthfully, I can’t give you my figure right now, but I am hoping for sub-four, 3.9% or something like that is what I’m hoping for. Having said that, Grey County, South Bruce, put it back in the hands of staff, saying we can go through two days of deliberations and cut and slash and burn if that’s what we desire to do, and it’s not going to be the outcome that staff wants.”

Bartley suggested that later in the process, he may move to have staff bring a revised budget to council that reflects a lower required rate increase than the 7.10% included in the draft budgets.

The 7.10% rate increase, if it were to withstand council budget deliberations, would result in a property tax rate increase (municipal portion) of $183, or roughly $15.25 per month for the average home in Meaford with an assessed value of $300,000.

Last week, Grey County council approved their draft budget which will see a 1.48% rate increase in 2023 on the county portion of ratepayer tax bills.

Meaford staff anticipate that final approval of the 2023 budgets will take place on March 27, leaving ample time for ratepayer engagement. The Municipality will once again receive and publish budget questions from ratepayers, along with answers from staff during the course of the budget process. Questions can be submitted by emailing budgets@meaford.ca, calling 519-538-1060 extension 1746, or by dropping by the Administration Office located at 21 Trowbridge Street West, during regular hours of operation.

Those wishing to provide feedback to members of council directly can email council@meaford.ca.

More information on the Municipal Budgets, including the schedule and how you can get involved can be found at www.meaford.ca/Budgets. Paper copies of the budget are available upon request.

Next steps:

Public Engagement Session (Special Meeting of Council) – Wednesday, February 8, 6:30 p.m.

Council Budget Day – Operating – Thursday, February 23, 9 a.m. to 4 p.m.

Council Budget Day – Capital & Enhancements – Friday, February 24, 9 a.m. to 4 p.m.

Statutory Public Meeting (Special Meeting of Council) – Monday, March 20, 5 p.m.

Final Approval of 2023 Budgets – Monday, March 27, 1 p.m.