Stephen Vance, Staff

Meaford’s long-term debt continues to decline, and the amount owed by the municipality is just a fraction of the total debt that is allowed by the province. However with some big projects on the horizon new long-term debt is inevitable.

Treasurer Darcy Chapman presented a report to council on February 26 providing an update on municipal debt.

“Our debt has continued to go down over the past number of years as we’ve been paying off a lot of things and we haven’t really incurred any new debt,” Chapman told council.

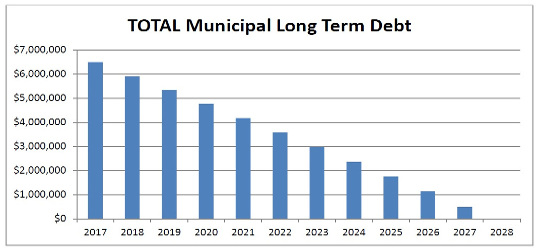

In 2010 Meaford’s long-term debt amounted to $10 million. By the end of 2017 Meaford owed roughly $6.5 million, and by the end of this year it will be less than $6 million, well below the nearly $45 million in new debt allowed by the province based on annual revenues.

“In the Province of Ontario, municipalities have the authorization to incur long-term debt for municipal infrastructure as long as annual debt repayments do not exceed 25% of net revenues,” Chapman told council in his report. “The Province provides an annual statement for municipalities known as the Annual Repayment Limit statement (ARL), outlining the revenue and debt servicing calculations. The Municipality of Meaford’s debt servicing costs, as a percentage of new revenues, are projected not to exceed the provincial annual repayment limit of 25%. For reference, the most recent ARL currently shows that the Municipality would be able to undertake additional debt of up to $44.98 million at an interest rate of 5% over 20 years. This would be a very favourable rate for such an extended period of time and most likely the maximum debt.”

While council and staff have focused on debt reduction in recent years, Chapman noted that additional debt of approximately $3 million is anticipated in 2018/19 for the new library. Mounting infrastructure projects could also require taking on additional debt in the years to come.