Stephen Vance, Staff

A special meeting of council was held on the afternoon of October 17 for the presentation of the 2017 draft municipal budget.

The proposed budget includes a 1.688 percent increase to the base budget, which will allow for increased funding for roads, bridges, and facility infrastructure needs. Should council approve a short list of proposed budget enhancements, including the hiring of additional transportation services staff, the development of a regional master fire plan, and additional funds for horticultural beautification in the downtown area, residents could see an approximate rate increase on the municipal portion of their annual property tax bills of roughly three percent – in line with the request made by council to produce a budget with a maximum three percent rate increase.

In September council directed staff to prepare a draft budget with dedicated rate increases of one percent for roads capital funding, one percent for bridge infrastructure funding, 0.5 percent for municipal facility infrastructure needs, as well as a 0.5 percent increase in the base operating budget.

Municipal staff appears to have exceeded those expectations with the draft budget, which includes the infrastructure funding increases requested by council as well as room for some budget enhancements, while staying under the three percent maximum increase requested by council. Staff was able to accomplish it by finding opportunities for savings within the base budget, including $116,800 in reduced capital works.

“This is extraordinary that you were able to find these savings, and apply them so we would only have a potential (base) increase of 1.688 percent, but I look at the overview of the projected increases of our overall budget starting next year of over five percent, and the next year over five percent, and then three and a bit, and then almost five percent again, which is a little startling in and of itself. So when I see 1.688, but I look ahead and I see these huge increases, should we not put the reduced capital works savings into the reserves to reduce next year’s five percent budget to perhaps four percent,” suggested councillor Mike Poetker.

Chapman told council that he doesn’t disagree, though he said that future increases could be even larger than is currently projected.

“I can’t disagree. We of course would always like a better base to start with for next year because it makes everything that much easier, and planning ahead certainly is worthwhile. I think what’s important to talk about is that the long-term plan on the operations is very much flat-lined over the next five years. We’re going to be able to contain costs long-term, at least that’s what we are projecting. Where the real pressure points are going to be is within capital, we’ve recognized that all along. Maybe five percent won’t be the number next year, but until we get our asset management plan fully implemented, it’s really tough to say. Maybe the increase should be ten percent every year for the next ten years – I wouldn’t disagree that probably will be a number that it will actually rattle out at. Now, that’s of course if we were actually able and willing to go to that step where we’ll be able to fully fund on our own every one of our asset needs. Every municipality in Ontario is going to be struggling with this in the same way, so it’s about how we can deal with these increases in a justifiable manner, and everything over and above that becomes our infrastructure gap, and that’s what we go back to the province for,” said Chapman.

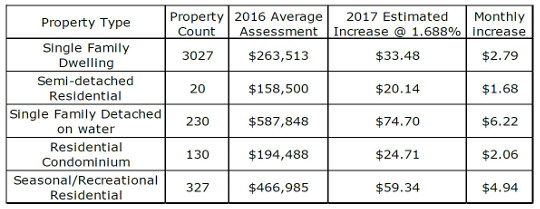

In his presentation to council, Meaford Treasurer Darcy Chapman told council that, should council approve the 1.688 percent base budget increase only, the impact on an average single family home with an assessment of $263,513 would be a municipal property tax increase of $33.48, or $2.79 per month. If council approves the full draft budget package with all proposed enhancements, a three percent rate increase will add $59.51 to the annual tax bill for an average single family home ($4.96 per month).

Impact of a 1.688% increase on residential property tax bills:

Impact of a 3% increase on residential property tax bills:

The proposed rate increases for users of Meaford’s municipal water and wastewater services in 2017 is 4.2 percent for water, and 4.61 percent for wastewater, down from recent years which have seen increases in excess of six percent.

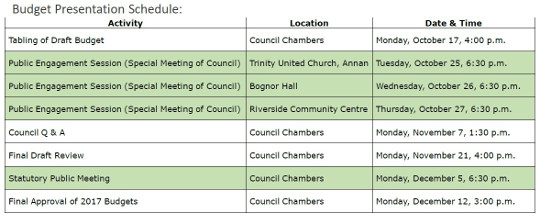

The next steps for the 2017 municipal budget deliberations will be a series of public meetings next week (see schedule) to present the draft budget and receive feedback from the public, followed by council deliberation in November before a statutory public meeting on December 5, with an anticipated final approval of the 2017 budget on December 12.

All budget documents are available on the municipal website (meaford.ca).