Stephen Vance, Staff

At their March 7 meeting, Meaford Treasurer Darcy Chapman provided his annual update to council on the municipal long-term debt.

During the 2010 municipal election, many expressed concern about Meaford’s debt load of approximately $10 million. In recent years the municipality has avoided taking on new debt, and that has resulted in a decline in the overall long-term debt which is now approximately $8.2 million, according to figures included in Chapman’s report to council.

While $8.2 million might seem like a lot of debt for a small municipality, Chapman noted in his report that provincial guidelines would permit Meaford to carry much more debt.

“In the province of Ontario, municipalities have the authorization to incur long-term debt for municipal infrastructure as long as annual debt repayments do not exceed 25 percent of net revenues,” Chapman told council. “The province provides an annual statement for municipalities known as the Annual Repayment Limit statement, outlining the revenue and debt servicing calculations. The Municipality of Meaford’s 2016 Annual Repayment Limit statement from the province states that the Municipality is utilizing 6.61 percent of net revenues to service debt and is only utilizing 26.43 percent of the legislated capacity of net revenues.”

Last year council approved a revised debt management policy with the goal of ensuring future financial sustainability.

Central to the Debt Policy are the following objectives:

-

Ensure long-term financial flexibility and sustainability

-

Limit financial risk exposure

-

Maintain the credit rating

-

Minimize long-term cost of financing

-

Comply with statutory requirements including monitoring and reporting

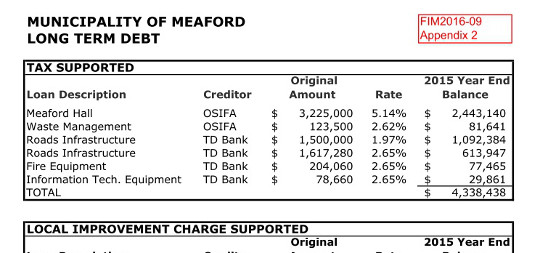

The bulk of Meaford’s long-term debt can be attributed to two large loans, one that falls under tax-supported repayment, and the other is repaid utilizing water system fees. A $3.2 million loan taken on by the municipality during the renovation of Meaford Hall has $2.4 million remaining, while a water treatment plant loan of $2.7 million currently has a balance of $2.07 million.

How much debt could Meaford assume if it chose to do so? Quite a bit more than the current $8.2 million, according to Chapman’s report.

“The Municipality of Meaford’s debt servicing costs, as a percentage of new revenues, are projected not to exceed the provincial annual repayment limit of 25 percent. For reference, the most recent Annual Repayment Limit (ARL) as provided by the Ministry of Municipal Affairs shows that the Municipality would be able to undertake additional debt of up to $42.68 million at an interest rate of 5 percent over 20 years. This would be a very favourable rate for such an extended period of time and most likely the maximum debt,” advised the Treasurer.