Stephen Vance, Staff

Meaford’s long-term debt continues to decline. During the 2010 municipal election campaign, many residents expressed concern over Meaford’s debt load, which at the time was approximately $10 million.

Meaford’s long-term debt continues to decline. During the 2010 municipal election campaign, many residents expressed concern over Meaford’s debt load, which at the time was approximately $10 million.

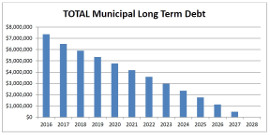

Councils in the years since have committed to chipping away at the debt load, and a report provided to council at their February 13 meeting shows that the total long-term debt being carried by the municipality is now down to less than $7.4 million.

In his annual long-term debt update report to council, Meaford Treasurer Darcy Chapman noted that the municipality is carrying far less debt than is allowed by both the province and Meaford’s own internal policies.

“We have a bunch of goals that were established municipally aside from the provincial requirements. The province sets the maximum debt limit capacity for any municipality at 25 percent of all source revenues. There’s one appendix in the report that came from the province that shows that we have ample flexibility still within our debt-carrying capacity based specifically on the province’s established ratios. We’re somewhere in and around 25 percent of our maximum debt capacity from the province’s perspective,” Chapman told council when presenting his report.

The bulk of the debt reduction has taken place over the past four years. At the end of 2013, Meaford’s long-term debt totalled $9,789,425, dropping to $9,010,070 at the end of 2014 and to $8,206,280 by the end of 2015, before dropping by nearly $1 million in 2016 to $7,372,062 by the end of 2016.

Meaford’s long-term debt is divided into several categories:

Tax Supported Debt, which includes debt taken on in previous years for roads infrastructure, Meaford Hall, information technology equipment, and fire equipment, totalled $3,792,182 at the end of 2016.

Local Improvement Charge Supported Debt includes just one loan taken out for the Leith water system, and amounted to $360,189 at the end of 2016.

Water User Rate Supported Debt for the water treatment plant amounted to $1,956,751 at the end of 2016, while Waste Water User Rate Supported Debt totalled $1,052,349.

Development Charge Supported Debt, which includes loans for a fire truck and water infrastructure, adds another $196,505 to Meaford’s total long-term debt.

While Meaford’s debt has been declining in recent years, Mayor Barb Clumpus asked Chapman, given the current low interest rates, if now would be a good time to take on some additional debt in order to address some roads infrastructure needs.

“With the interest rates being as low as they are now, I’m wondering if, with the capacity that we do have for increased debt, there’s any advantage to be looking at our preservation model for road rehabilitation or bridges, one or the other, and increasing our debt-load now might address some of the worst roads, or a project through the preservation model that would vastly improve our ability to maintain in the future,” Clumpus asked Chapman.

Chapman agreed that the current borrowing climate provides some advantages if council is willing to take on new debt.

“We do have a lot of roads in the ‘bad’ category that we told council a few years ago that unless there was some other magical pot of money, we weren’t going to be doing anything with those roads for ten years,” Chapman told council. “We could always move those roads up (in the queue). The bridge infrastructure report showed that over the next eight years we have some flexibility in sustaining the infrastructure over that period of time, but that being said, that overall portfolio is still going to require some debt financing over the next number of years. So we will be incurring debt. I think the big thing is that although the rates are great, we need to have a project that we’re working on in order to secure that great long-term rate through Infrastructure Ontario, we can’t just borrow the money and put it in the bank, it has to be for a specific project.”

Chapman stressed that any new debt taken on by the municipality must be well thought out, and the length of the term of the debt must not exceed the life-span of the project for which the funds were borrowed.

“There is good debt. Bridges are great debt because they have 50 to 70 year life spans, so borrowing money is not a problem. Water and sewer infrastructure likewise have very long life cycles. If we’re looking at redoing an asphalt surfaced road, that’s probably fine as well because we wouldn’t be dealing with any maintenance for at least 15 years, so as long as we didn’t borrow money for longer than 15 years, it’s still good debt. Some of the roads that need work though are those gravel roads that need to be reconstructed and have better drainage put into them, that’s not really good debt because ultimately the debt window would be so short because the lifespan of that road is only three to five years, you might as well pay for it right now, because you certainly wouldn’t want to extend the debt over 10 to 15 years where you’re actually paying for it well beyond the useful life of that asset,” Chapman advised council.