Stephen Vance, Staff

In a report to council presented at the September 11 council meeting, municipal staff had recommended that council direct staff to prepare a draft budget that would include a tax levy increase of up to 3.7 percent. However members of council, recognizing the massive infrastructure gap facing the municipality in the years to come, along with pressures on the operating budget largely beyond the control of the municipality, asked staff to target a four percent increase.

The proposed rate increase would allow for a 1.5 percent increase in the tax-supported operating budget, a one percent tax levy increase dedicated to roads infrastructure, a one percent increase allocated toward bridge infrastructure, and a 0.5 percent levy increase for facility infrastructure.

Meaford Treasurer Darcy Chapman noted that in the years to come annual property tax increases will be 2.5 percent at minimum, solely to address coming infrastructure needs.

“We need to recognize that we have a long term plan in place to address our roads, our bridges and our facilities. These are at least ten year plans, if not longer, that this council has adopted, and hopefully future councils will stick to it as well,” Chapman told council. “So in that regard, no matter what we do from here on out for the next decade we should be looking at it as a base starting point, a 2.5 percent increase in the tax rate every single year. Because if we do not increase the tax rate by 2.5 percent every single year, there is no way we can fund additional money for roads at one percent, for bridges at one percent, and facilities at half a percent.”

Chapman noted that allocating additional funds for infrastructure over the past two years without hefty tax increases was made possible largely due a dedicated effort to find cost savings and efficiencies within the operating budget, in part thanks to the ongoing service delivery review initiative, however there is little fat left to trim.

“Unfortunately we’re at the point now where we’ve really, for lack of a better term, trimmed the fat away from the budget and gotten to the point where we really are providing services at the base amount,” noted Chapman. “So moving forward, I don’t want anyone to be shocked that every single year from here on out, staff is going to be proposing tax rate increases that start with 2.5 percent for infrastructure renewal, and then whatever we need for operating.”

When asked by Councillor Steven Bartley about Meaford’s infrastructure funding gap, Chapman said that the municipality currently has an approximate annual shortfall of some $7 million per year.

“At AMO (Association of Municipalities in Ontario conference) the Liberal government, the NDP and the PCs acknowledged the fact that as municipalities we are short-funded $4.9 billion per year on infrastructure. They acknowledge that, but they haven’t come up with a plan to help us with that,” noted Bartley, prior to asking the treasurer to bring council up to date on the municipal infrastructure funding gap.

That infrastructure funding gap puts Meaford as well as virtually all municipalities across the province in a bind, as ratepayers would not be able to afford the tax levy increases required in order to properly fund infrastructure needs, and little help has been coming from upper levels of government.

“We’re going to have to make sacrifices as a community in the service levels we’re going to have to accept from an infrastructure standpoint,” Chapman told council. “Is one break acceptable, is ten breaks acceptable in a watermain? Is one pothole acceptable, or ten? Is gravel acceptable where surface treatment used to be? Those are going to be the tough decisions that councils will have to make over the next three years as we build this asset management plan.”

“Pretty scary,” noted Councillor Bartley.

Given that municipal expenses for goods and services like fuel and electricity increase year over year, ratepayers can expect annual property tax increases of four percent or more.

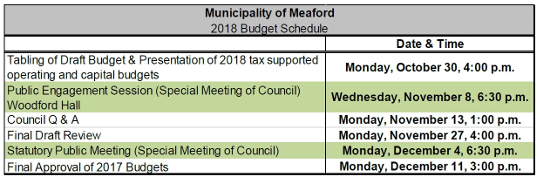

Per the schedule included below, a draft budget will be presented to council on October 30, followed by a public engagement session at Woodford Hall on November 8, with a target of December 11 for final approval of the 2018 budget. All budget-related documents will be available on the municipal website.