Submitted by: Glen Izzard, CIM; Investment Advisor, Portfolio Manager

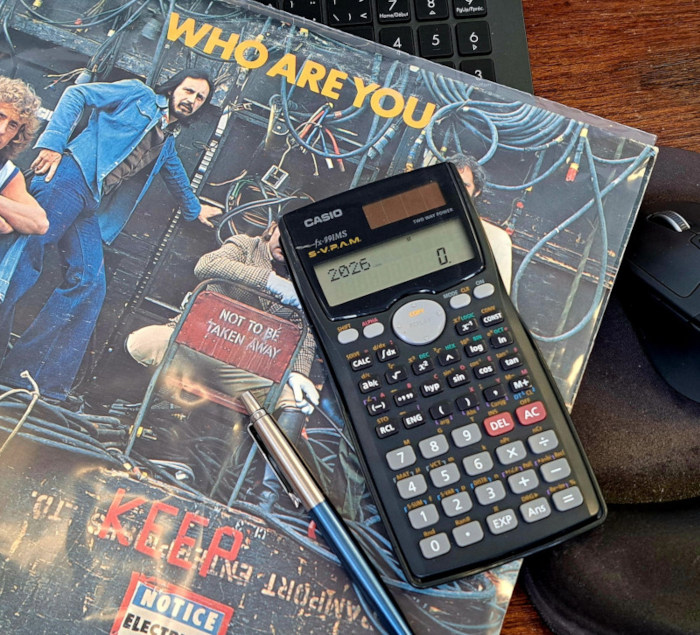

In 1978, the legendary rock band The Who released a song inspired by guitarist Pete Townshend’s rough day in New York’s Tin Pan Alley. After an excruciating meeting over royalties, a few drinks, and plenty of frustration, he wrote the now-iconic lyrics to Who Are You?— a tune that still echoes through car speakers today.

If you’re a Baby Boomer — born between 1946 and 1964 — chances are you know the song well. You might even find yourself belting out that famous line, “WHOOOO are you…” on a long drive down Highway 26. And in a way, it’s a fitting question for your generation, as many of you move through one of life’s biggest transitions: RETIREMENT.

Redefining Retirement — and Yourself

Your parents’ generation often viewed retirement as a finish line, typically planned and managed by the husband. Today’s Boomers, however, are redefining the concept entirely. Retirement planning has evolved into a shared — and often self-directed — endeavour.

Women, in particular, are now financial decision-makers, entrepreneurs, and investors in record numbers. They represent a growing percentage of the world’s wealthiest individuals, shaping a new era of financial independence and longevity.

And longevity really is the key word. Compared to previous generations, Boomers are living longer, healthier lives — and they’re working longer too. Many are choosing not to stop working completely but instead to reinvent themselves. ‘Retirement’ now often means a portfolio of activities: part-time consulting, volunteering, travel, education, or passion projects.

So, the question remains: what are Boomers planning to do with all that extra time — and how prepared are they financially to do it?

Five Faces of the Modern Boomer

Gerontologist Ken Dychtwald conducted an illuminating survey of over 300 Boomers, identifying five distinct approaches to life after traditional work:

- Wealth Builders (31%) – Energetic and entrepreneurial, these Boomers plan to continue earning, investing, and expanding their wealth.

- Anxious Idealists (20%) – They want to give back through volunteering and philanthropy but worry their resources won’t stretch far enough.

- Empowered Trailblazers (18%) – They see retirement as a time for exploration, learning, and contribution — supported by solid financial footing.

- Stretched & Stressed (18%) – This group faces financial pressure and uncertainty about covering essentials such as housing and health care.

- Leisure Lifers (13%) – They plan to make relaxation their full-time pursuit, embracing travel, hobbies, and early retirement.

Each approach reflects a different vision of purpose, fulfillment, and financial readiness.

The Reality Check

Most Canadian Boomers say they’re prepared for retirement — but surveys reveal a gap between confidence and clarity. While nearly 80% feel ready, fewer than half know how much they actually need to save or whether they’ve saved enough to sustain their goals.

Still, the outlook is bright. Boomers are projected to enjoy higher levels of education, better health, and greater wealth than any previous generation of retirees. They’ve built a foundation of prosperity and opportunity — one that allows them to ask bigger, more personal questions about what truly defines a fulfilling life.

A Valentine’s Reflection: What (and Who) Do You Love?

As February rolls in, it’s not just the lyrics of The Who that should make you pause — it’s also a good time to reflect on love. Not just romantic love, but the kind that shows up in your priorities: the people, causes, and experiences that matter most.

Financial planning, at its best, is an act of love. It’s how you ensure your spouse, family, and future self are protected and empowered. It’s how you create freedom — to give, explore, and live on your own terms. Whether you’re a Wealth Builder, an Empowered Trailblazer, or even feeling a bit Stretched & Stressed, your financial plan should be rooted in what (and who) you care about most.

As you navigate the next chapter of your life, take a moment to hum that familiar chorus and ask yourself: Who are you — financially, personally, and purposefully? Maybe it’s time to fall in love again — with your goals, your dreams, and your financial future.

About Glen Izzard

Based in Meaford, Ontario, Glen Izzard is a Chartered Investment Manager (CIM®) and Discretionary Portfolio Manager with over 15 years of experience helping clients navigate investing, cash flow, estate planning, and retirement transitions.

Known for his client-first approach, Glen focuses on building clarity, confidence, and long-term results. An active community supporter, he serves as treasurer for the Meaford Chamber of Commerce and as Assistant Coach with Georgian Bay Lightning Hockey. Glen’s mission is simple: provide thoughtful guidance, practical strategies, and a steady hand so clients can stay on course — financially and in life.

Please Contact: (226) 909-8688 glen.izzard@optimizewealth.com www.greenpeaksecurities.ca

This article is for informational purposes only and does not constitute personalized investment advice.